Key Takeaways From Harley-Davidson’s Q2 2023 Report

Looking beyond the numbers

Harley-Davidson had a pretty eventful second quarter of 2023, with the launch of two new CVO models, the Fast Johnnie Enthusiast collection, the Electra Glide Highway King Icon model, as well as a pause in production due to part supply issues. And, of course, Harley-Davidson just held its big 120th anniversary homecoming celebration, though technically that happened during the third quarter. Putting that big shindig aside, it was quite a busy few months for the Motor Company.

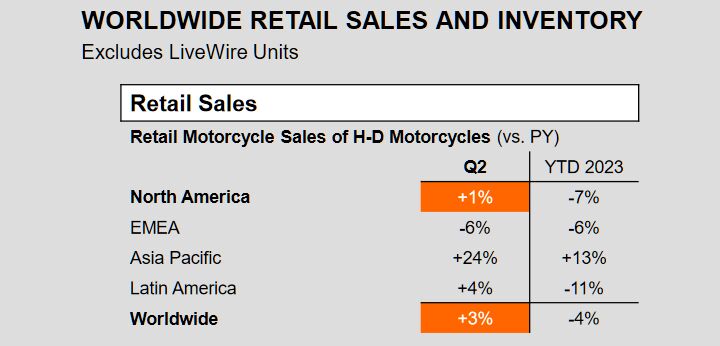

The first quarter saw a 21% increase in motorcycle sales revenue despite a 12% drop in the number of actual bikes sold, but the second quarter went in the opposite direction. Unit sales were actually up 3% worldwide, while motorcycle sales revenues were down 4%. Go figure.

Harley-Davidson reported sales of 51,500 motorcycles in the quarter, compared to 50,200 units in the same quarter of 2022. Motorcycle sales revenue, however, dipped to $890.9 million from $935.2 million. Harley-Davidson reported $1.2 billion in revenue from its motorcycle business, down from $1.3 billion in 2022.

Overall, including LiveWire and Harley-Davidson Financial Services, Harley-Davidson reported a net income of $178 million in the second quarter of 2023, compared to $215.8 million in the same period last year.

Looking past the numbers, here are some other key takeaways from Harley-Davidson’s second quarter.

Production Stoppage

Harley-Davidson paused production in June after it was notified of a quality issue on brake hose assemblies provided by a tier-2 supplier, Proterial Cable America. Full manufacturing operations resumed at Harley-Davidson’s York facility after a couple of weeks, but the delay resulted in an uneven product mix, and a 10% decrease in global wholesale shipments. The new CVO Road Glide and CVO Street Glide were not affected by the delay, as they do not use the same brake hose assemblies.

Due to the timing of the stoppage, its full effects won’t be seen until the Q3 numbers are in.

LiveWire Update

LiveWire was in a strange place, through both the first and second quarters. Yes, the electric brand continues to bleed money, reporting a net loss of $40.7 million, but that’s what you would expect from a newly established company that hasn’t fully ramped up operations yet. A loss of $40.7 million sounds like a lot, but considering Harley-Davidson apparel sales alone topped $66 million (and even then, that’s down 14% from 2022), it’s a loss the company is willing to take at this stage.

Of course, that excuse only holds for so long, and that’s where the next quarter will be more interesting. The company sold just 33 LiveWire One over the second quarter of 2023, compared to 225 units in the same period the year prior (21 of those came when they were still branded as Harley-Davidson LiveWires). Karim Donnez, LiveWire chief executive officer, says $260 million in cash and cash equivalents, plus access to a nonbinding term sheet with Harley-Davidson worth another $200 million, so the financing is there to get through the current stage. Combining the first two quarters, LiveWire reports a net loss of $61.9 million, and the company forecasts a year-end loss of $115 to $125 million. At some point, however, the numbers will have to start turning around.

The third quarter will be a better barometer of how the company will proceed, thanks to a number of key developments. LiveWire expanded operations to Europe, late June, at the tail end of the second quarter, so European sales won’t really have an impact until the current quarter.

The S2 Del Mar was also pushed back to this quarter, and LiveWire confirmed production has now begun, with the first units just started rolling off the production line this week. The delayed launch may have also played a role in the declining sales figures for the LiveWire One, as Donnez says riders may have been holding off for the more affordable Del Mar.

Progress is also continuing on the next model after Del Mar, the third model of the brand and the second to make use of the S2 platform.

LiveWire now forecasts sales of 600 to 1,000 units on the year, down from the previous outlook of 750 to 2,000. With just 96 LW1 units sold in the first half, LiveWire will need a strong response to the Del Mar and a good showing in Europe to reach its target.

Growth in Asia

Harley-Davidson reported second quarter sales of 7,500 motorcycles in the Asia-Pacific region, a 24% increase from 2022, with strong demand in Japan, China, and Australia driving the growth. The Asia-Pacific region is not only the fastest growing region for Harley, it’s also inching closer to its second largest region, the Europe, Middle East, & Africa region, which reported sales of 8,100 units in the quarter.

Jochen Zeitz, Harley-Davidson chief executive officer, also clarified a few details about the company’s relationship with Hero Motocorp. Hero is Harley-Davidson’s distributor for India for 600cc and larger models, but the recently launched X440 is driven almost entirely by Hero, under a licensing agreement. That means the sales from the X440, and any other models produced under this agreement, will count entirely on Hero’s bottom line, and the agreement will only appear in Harley-Davidson’s books as licensing income.

Dealership Revamp

The second quarter saw the first dealership to complete its redesign under Harley-Davidson’s Project Fuel program. The dealership, Harley-Davidson of Wesley Chapel in Lutz, Florida, completed the transformation to modernize the dealer experience. Harley-Davidson says more revamped dealerships will come online over the next few quarters.

Become a Motorcycle.com insider. Get the latest motorcycle news first by subscribing to our newsletter here.

Dennis has been a part of the Motorcycle.com team since 2008, and through his tenure, has developed a firm grasp of industry trends, and a solid sense of what's to come. A bloodhound when it comes to tracking information on new motorcycles, if there's a new model on the horizon, you'll probably hear about it from him first.

More by Dennis Chung

Comments

Join the conversation

To bad Harley did not focus on quality Instead of profits their motors have problems, press cranks should have been welded to keep them true using cheaper bearings I just cannot figure it out save a nickel have the customer spend a dollar go figure.

I am disappointed that there isn’t more developments in the Adventure segment. This is a fast growing part of the motorcycle industry and Harley proved they were able to deliver an exciting competitive machine with the Pan America but there is so much more to be done in the 700 to 900 cc lighter weight machines. European brands are having significant growth and they keep developing more models hitting floors of dealerships.